![]()

Damian Radcliffe

| October 8, 2021

| Topic: Innovation

Qatar is part of a region with huge variations in digitisation.

Image: Marvin Fernandez / Getty

The Middle East and North Africa (MENA) is a large and diverse region, which is anything but homogeneous in terms of its history, culture, language and use of technology.

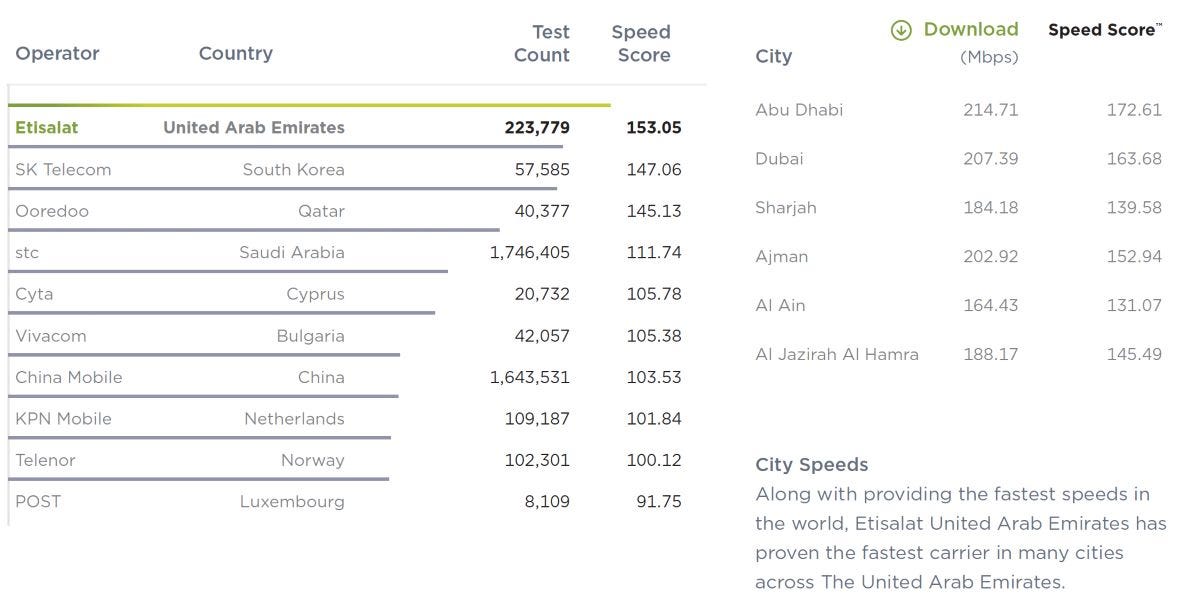

Screenshot from Mobile Speedtest Award Report for the World, Ookla.

Image: Screenshot / Ookla

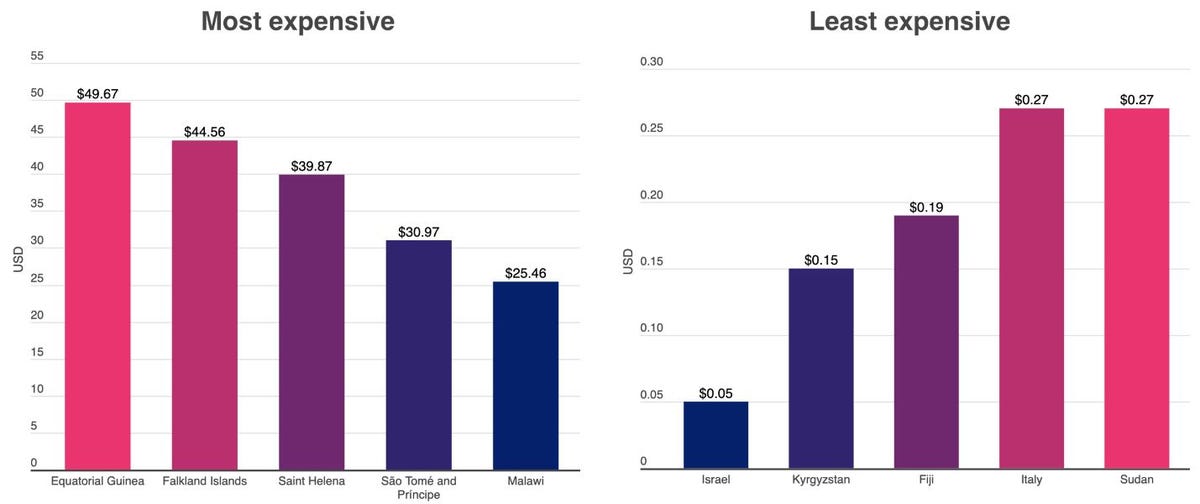

Yemen has the second slowest broadband in the world, with average internet download speeds of 0.68Mbps. Only Turkmenistan (0.50Mbps) is slower. Source: Cable.co.uk and M-Lab, September 2021Israel is the least expensive country in the world to buy 1GB of mobile data (costing $0.05) with Sudan the fifth least expensive ($0.27). In contrast, the average price of 1GB of mobile data in Yemen costs $15.98. Source: Cable.co.uk, April 2021

The most – and least – expensive countries in the world to purchase 1GB of mobile data.

Image: Cable.co.uk

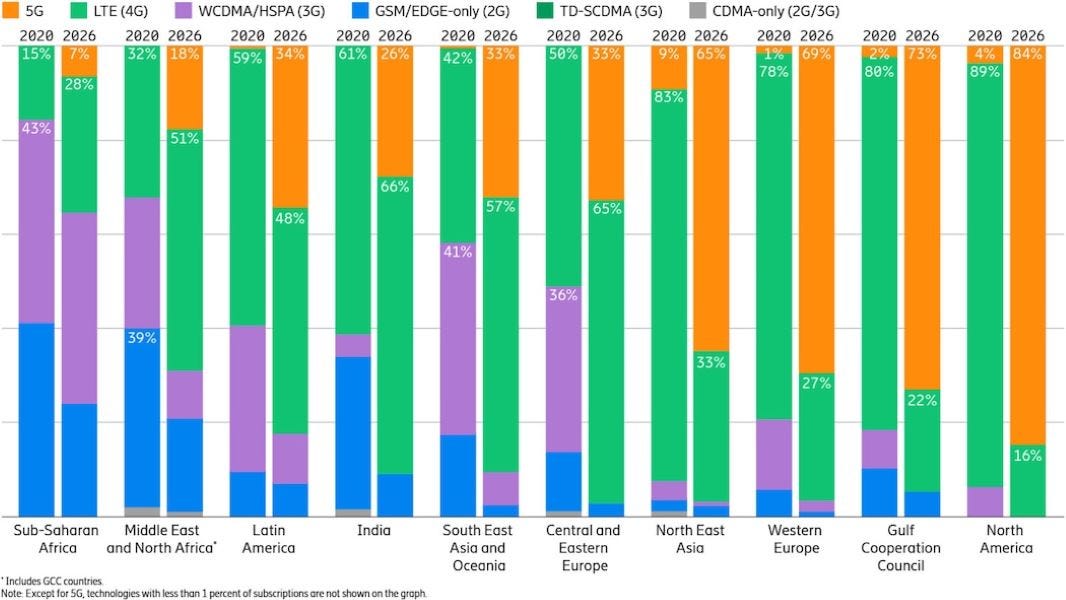

Google, WhatsApp and YouTube are each in YouGov’s list of the Top 10 brands for UAE, Saudi Arabia and Egypt. Their research captures brand perception among consumers, in rankings typically dominated by national brands. Source: YouGov, November 2020The region is likely to reach around 150 million 5G subscriptions in 2026. That’s up from c.1 million at the end of 2020. Source: Ericsson, July 2021Nearly three-quarters (73%) of total mobile subscriptions within the Gulf Cooperation Council (GCC) are predicted to be for 5G by 2026. That would make it the second-highest region in the world for 5G penetration, behind North America (84%). Source: Ericsson, June 2021

Mobile subscriptions by region and technology (% 2020 vs 2026).

Image: Ericsson

Digital divides

The internet was used by 61.3% of men and 47.3% of women in the region in 2019. Source: ITU, April 2020Across the Middle East, 80% of the unbanked population have a mobile phone, but fewer than 7% of this group has a mobile money account. Source: World Bank Group, October 2020Pre-COVID, only 8% of SMEs in the wider MENA region had an online presence (versus 80% in the US,) and only 1.5% of MENA’s retailers were online. Source: OECD, March 2021

Digital payments were made or received by 33% of adults in MENA in 2019. This is compared to 44% of adults in other developing countries and 91% of adults in high-income countries. Source: World Bank Group, October 2020Fewer than one in four (38.4%) rural households had access to the internet in 2019, compared to more than seven in ten (74%) of urban households across the Arab States. Source: ITU, April 2021

Investment and spending

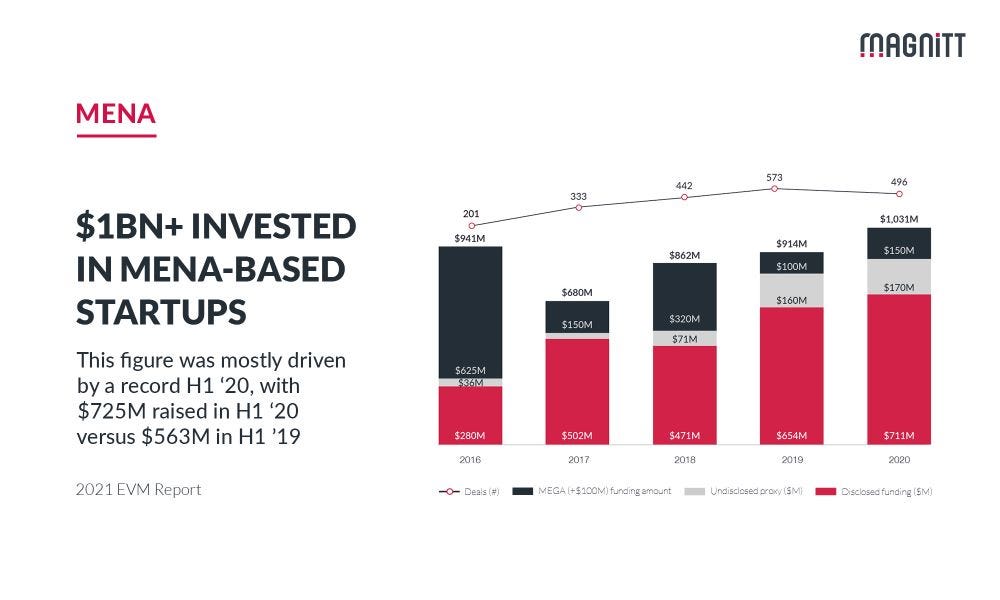

Despite COVID-19, annual investment in startups hit $1 billion in the MENA region for the first time in 2020. There were 496 deals, the largest being a $150M Series E round for the property portal company EMPG (Emerging Markets Property Group). Source: MAGNiTT, January 2021

Annual investment in MENA-based startups, 2016-2020.

Image: MAGNiTT

Mobile operators will invest $70 billion in infrastructure rollouts between 2019 and 2025. Source: GSMA, November 2020IT spending in the region is projected to total $171 billion in 2021, up 4.5% from 2020. Enterprise software, spending on servers, applications and infrastructure software are top priorities for CIOs in MENA, along with increased spending to support remote-working technologies. Source: Gartner, April 2021

Image: Gartner

Challenges and opportunities

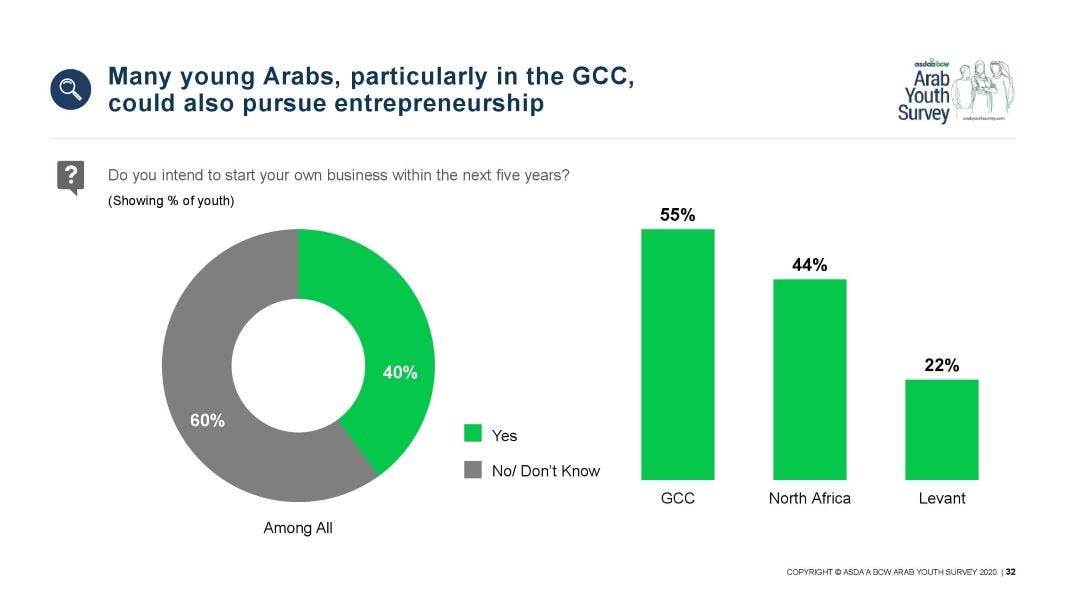

AI could contribute more than $300 billion by 2031 to Middle East GDP. UAE appointed its first minister of AI after estimating this technology might add $182 billion to the economy by 2035. Source: IBM, February 2020Data breaches in the MENA region are costly affairs. The financial impact of the “average” breach is $6.53 million, well above the global average of $3.86 million. Source: Ponemon Institute and IBM Security, August 2020Among young Arabs aged 18-24, 40% want to start their own business in the next five years. This aspiration is highest among young people in the Gulf (55%), followed by young people in North Africa (44%) and the Levant (22%). Source: Arab Youth Survey 2020, October 2020

Number of Arab youths interested in setting up their own business.

Image: Arab Youth Survey 2020

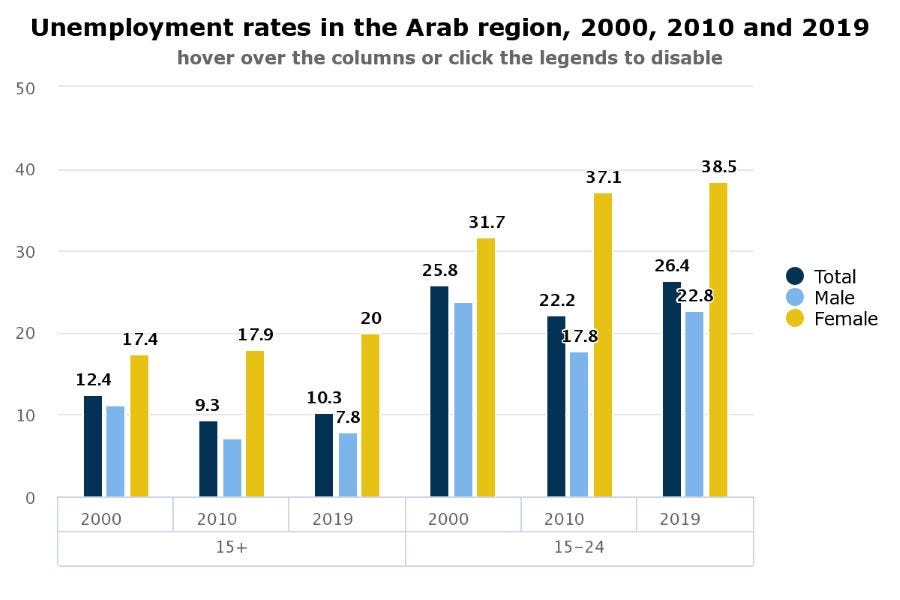

Pre-COVID, 26% of 15-24-year-olds in the region were unemployed, rising to nearly 40% of females. Youth unemployment has remained stubbornly high for the past decade, and may be one factor behind the entrepreneurial ambitions expressed by many Arab youths. Source: UNESCWA (United Nations Economic and Social Commission for Western Asia), August 2021

Image: UNESCWA

Innovation

United Airlines wants customers to pay for something outrageous

This tech company claims it can stop employees from quitting

Australia uses facial recognition drones to save koalas

What is AI? Everything you need to know

Related Topics:

Asean

CXO

Digital Transformation

Tech Industry

Smart Cities

Cloud

![]()

Damian Radcliffe

| October 8, 2021

| Topic: Innovation