![]()

Jonathan Greig

| October 20, 2021

| Topic: IBM

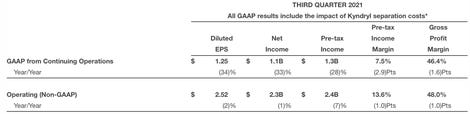

IBM published third-quarter financial results on Wednesday, showing steady gains in the cloud but declines in the IBM Z and Power systems.

The business technology giant delivered a non-GAAP EPS of $2.52 on revenue of $17.6 billion, up 1% year-over-year. Analysts were expecting earnings of $2.49 per share on revenue of $17.79 billion.

IBM said total cloud and cognitive software revenue was $5.7 billion for the quarter, up 2.5%.

Meanwhile, systems revenue fell 11.9% to $1.1 billion driven by declines in the IBM Z and Power systems. Storage Systems grew 11%.

Global Technology services, or GTS, posted $6.2 billion in revenue, down 4.8%. Global Business Services revenue (which includes Consulting, Application Management, and Global Process Services) was $4.4 billion, up 11.6%.

Red Hat revenue was up 17%.

“We again had solid cash generation for the quarter and over the last year, while maintaining a strong balance sheet and the liquidity to support our hybrid cloud and AI strategy,” said James Kavanaugh, IBM senior vice president, and chief financial officer.

“Our post-separation portfolio mix is shifted toward our growth vectors, with a higher-value recurring revenue stream and strong cash generation, allowing us to continue to invest in the business and provide attractive shareholder returns.”

IBM

As for the outlook, Wall Street is looking for IBM to report fourth-quarter non-GAAP earnings of $4.22 per share on revenue of $20.7 billion.

IBM is in the process of spinning off its managed infrastructure services business, Kyndryl. Once the spin-off is complete in November, every IBM shareholder will receive 1 KD share for every 5 IBM shares they hold and IBM will retain 19.9% of Kyndryl’s shares outstanding.

“With the separation of Kyndryl early next month, IBM takes the next step in our evolution as a platform-centric hybrid cloud and AI company,” said Arvind Krishna, IBM chairman, and chief executive officer. “We continue to make progress in our software and consulting businesses, which represent our higher growth opportunities. With our increased focus and agility to better serve clients, we are confident in achieving our medium-term objectives of mid-single digit revenue growth and strong free cash flow generation.”

Tech Earnings

CBA wants to migrate two-thirds of compute into public cloud by the end of FY22

Micron sees supply-chain shortages ‘easing throughout 2022’

Progress Software stock surges as fiscal Q3 results crush expectations, raises year view

Salesforce sees operating margin gains, ups revenue outlook for fiscal 2023 amid strong demand, hybrid work

Facebook sees Q3 turbulence over Apple privacy changes

Adobe’s Q3 earnings: Four takeaways on SMBs, Creative Cloud, customer experiences

Snowflake launches Financial Services Data Cloud, touts big customer wins

Oracle shares fall with Q1 revenue miss

Related Topics:

Big Data Analytics

Artificial Intelligence

Cloud

Enterprise Software

Data Centers

![]()

Jonathan Greig

| October 20, 2021

| Topic: IBM